Unlocking Your Financial Future: ProjectionLab's Unique Benefits

In today’s fast-paced world, having control over your finances is essential, especially in planning for your future. ProjectionLab stands out as a powerful DIY financial planning tool that allows users to visualize their financial trajectory over decades—enabling you to plan for retirement, significant purchases, or even lifestyle changes.

What is ProjectionLab?

ProjectionLab isn't just another budgeting app; it’s a comprehensive planning platform designed to help you take the reins of your financial destiny. By allowing you to manually input your financial data—like income, expenses, and debts—without requiring any forced account linking, it provides a privacy-first approach to managing your financial future. You can explore various financial scenarios and assess your likelihood of meeting your goals with clarity and confidence.

Key Features of ProjectionLab That Make Planning Accessible

This tool is loaded with features, offering:

Retirement Success Assessment: Understand the likelihood of achieving your retirement objectives with real-time projections.

Scenario Analysis: Utilize 'what-if' scenarios to evaluate the impacts of different financial decisions, providing flexibility in your planning.

Monte Carlo Simulations: Test best- and worst-case outcomes, giving you insight into potential risks and rewards.

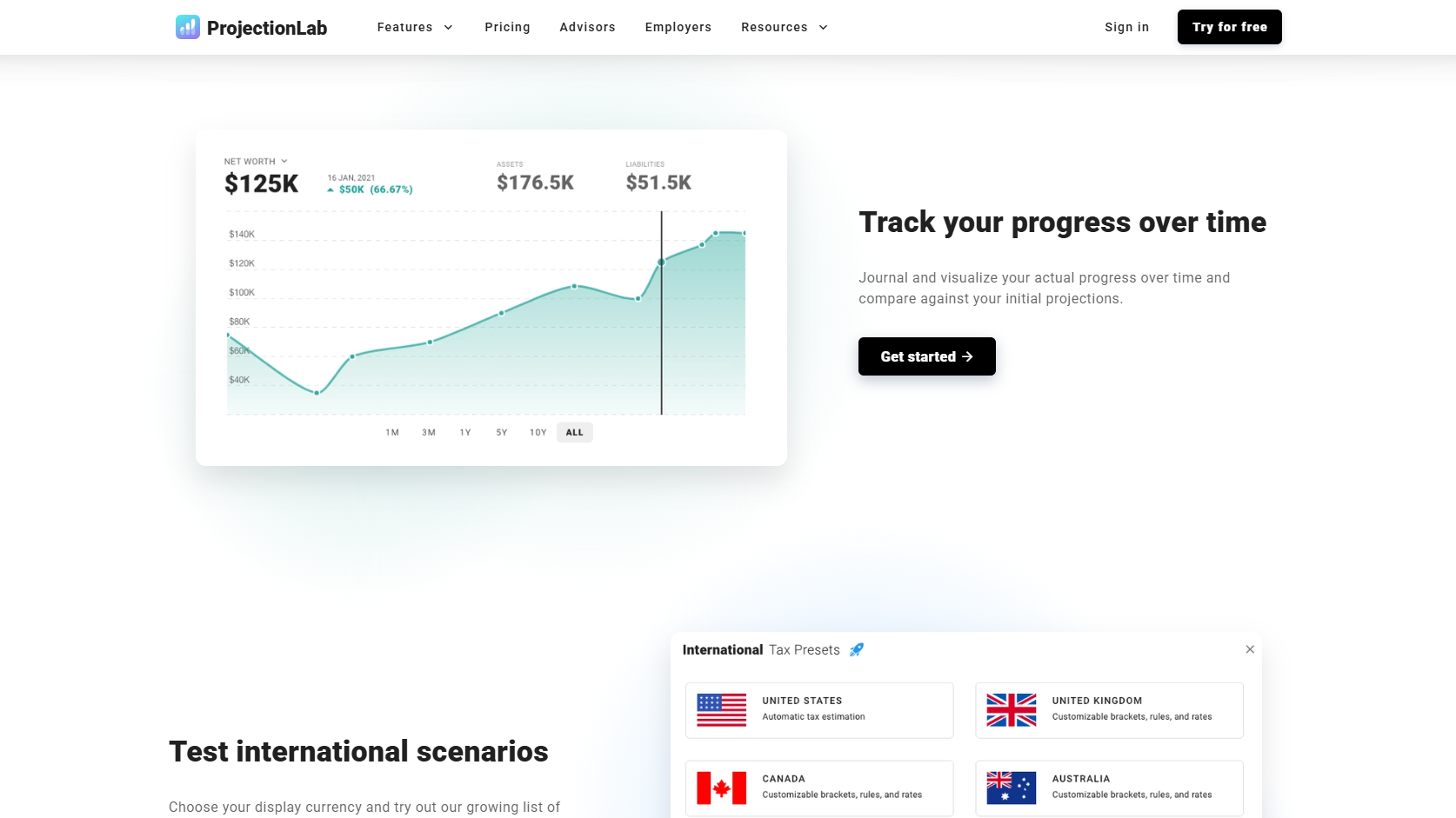

Future Cash Flow Tracking: Visualize your net worth progress with easy-to-read charts and graphs.

Privacy Protection: By manually entering data, you control what remains private, a critical aspect in an era of data breaches.

Why Only a Budget Tracker Isn’t Enough

Many budgeting apps track daily expenses and set limits, yet they often fall short in helping users envision their long-term financial futures. By solely focusing on day-to-day transactions, individuals can miss out on strategic financial planning opportunities that impact their lives years down the line. ProjectionLab empowers you to look beyond the immediate, focusing instead on your broader financial goals.

Practical Steps for Effective Financial Planning

Using ProjectionLab effectively requires several actionable steps:

Identify Your Goals: Outline what you want to achieve—be it retirement, buying a home, or funding your children’s education—and use ProjectionLab to map out these objectives.

Input Accurate Data: Provide realistic figures for your income, expenses, and other financial commitments to get the most beneficial insights.

Regularly Update Your Projections: As life changes—new jobs, income changes, or family growth—feed that data into ProjectionLab to keep your planning relevant.

These steps ensure that you not only harness the capabilities of ProjectionLab but also actively engage in your financial journey.

Envisioning the Future: The Role of DIY Financial Tools

As financial literacy and self-management grow in priority for many, DIY tools like ProjectionLab play a pivotal role in helping users feel empowered about their finances. In a recent survey, a notable percentage of individuals expressed a desire to be more involved in their financial planning—this software meets that need, helping you visualize your journey through impactful projections.

Conclusion: Take Control of Your Financial Future Today

If you want to step beyond simple budgeting and make informed decisions that will shape your financial future, consider trying ProjectionLab today. Emphasizing control, privacy, and strategic planning, this tool is tailored for anyone seeking to prepare methodically for their financial destiny.

Add Row

Add Row  Add

Add

Write A Comment